I know that many people reading this will not agree with me, but I’m still going to say it. “No, you do not need that credit card.” I can’t emphasize the importance of critically looking at the advantages and disadvantages of having a credit card. Especially in a world where credit cards are the primary way of paying and you need a credit score, especially in the US,. I’m not saying you’ll never need a credit card. I’m just saying that you probably don’t need one as soon as you think you need one.

Many young people, including myself, grow up with this notion that they have to get a credit card the minute they turn 18, if not younger. Let me tell you a story. You don’t need one. You’re already having a hard time with finances. How you may ask?

Well, if you didn’t grow up rich or didn’t get a full scholarship to college, and you want to study, you’ll probably come out with thousands of dollars in debt. That is absurd. To start your twenties with tons of debt is insane. I can’t believe how many young Americans just accept the fact that they will have to pay an absurd amount of money for tuition.

First Jobs

If that doesn’t explain why you don’t need a credit card, then I hope the rest of this blog post does. Most young people, including myself, barely were taught anything about finances or budgeting. They get their first job, blow most of the money on going out or shopping or whatever, and live paycheck to paycheck. Do you think you can also manage to pay your credit card off on time if you can’t even control how you spend the money coming in? I am speaking from my own experience and from what I have seen with my friends and family.

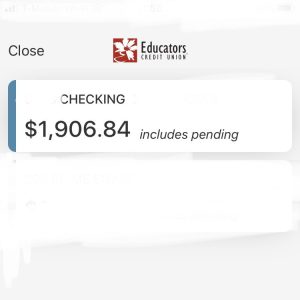

In the past, I spent an incredible amount of money on buying new clothes and shoes. Taking Ubers everywhere when I lived in New York. Eating almost every single meal out. I didn’t prioritize saving. I thought that $1800 in savings was a huge amount of money.

Boy was I wrong. This never happened to me, but it can happen to me or anyone else. You lose your job, lose your health insurance, barely get anything from unemployment, what then? Put everything on your credit card and then spend years paying it off?

Paying Interest

That’s where the credit card comes in. An absurd number of people, especially young people, pay a lot, if not everything, on their credit card. Every month, they pay the minimum payment but forget that the rest of the balance gathers interest. A lot of the time, the money people spend on their credit cards isn’t even within what they make. How is that okay? No one should be spending a crazy amount of money on their credit card and accruing interest if they can’t afford it.

And let me tell you: if you are spending more than you make, you cannot afford it. I know that’s a hard truth, but it is the truth. If you make $1500 or whatever the number is a month after taxes and live on your own with no financial assistance, you cannot afford to be shopping every month and eating out several times a week. It’s just not in your budget.

Be honest with yourself. Look at what you are spending on. You should be living within your means. Everyone should. Spend the money you make and try to save something every month. Even if something is $5 a month. Every dollar makes a difference. You’re going to be spending so much more paying off interest or a late charge if you don’t make that credit card payment. You don’t need a credit card. There are other ways of building your credit score like making sure to pay all your bills on time and in full.

Harm Versus Good

I know that many credit cards offer cashback or rewards for putting your bills and expenses on a credit card. But is it really worth it? Maybe it is for someone else, but not for you. Are you living paycheck to paycheck and can barely stay to your budget? Then the disadvantages of getting a credit card outweigh its advantages. You probably think you need that credit card because of family/friends/advertisements pressuring you.

My Finances

I am 22 years old. I lived on my own on and off since I was 18 years old. I’ve lived with my boyfriend for almost two years now, so yes, I am at an advantage financially. And yes, I have much more saved now, since I don’t have to pay for everything myself.

And yes, I am lucky enough to now live in a country where putting everything on your cc isn’t as much a norm like it is in the US. There is no such thing as a credit score in Europe like in the US. People focus more on how much debt you have and if you pay it off regularly and in full.

But before I moved in with him in the Netherlands, I lived in the US. I paid for all my day to day things myself. And I felt the pressure to get a credit card. I paid rent, groceries, transportation, my phone bill, and everything else myself. And I did it all without having a single credit card. I saved as much as I thought I could.

I could have saved more if I didn’t spend so much money traveling, shopping, and eating out. I never had to overdraft my bank account or even think of getting a credit card. I always made sure that my bills were paid before I could even think about spending money on unnecessary things.

It could be in that in the future, I will need a credit card. Maybe to rent a car or buy a house. But I’ve recognized that I don’t need one right now. I will do everything in my power to not get a credit card. I know myself. I am tempted to spend beyond my means, so why would I put myself in such a position?

I urge you to critically look at your finances and determine if you really need that credit card or another credit card. Maybe you can save money in other ways but cooking more at home or repurposing old clothes. Think of ways you can get rid of that credit card if it’s causing more hard than good. I’m here if you need me.

Follow my adventures and say hello to me on my Instagram.

What do you think about having a credit card? Is it useful and worth it to you?

Wait until you are a bit older, you are self employed or loose your job, something major breaks in your house,God forbid a medical emergency for a family member, yourself or a pet… You are still very young.