Someone recently commented on a post of mine saying that, of course, I can be happy because healthcare is free in Europe. And this comment isn’t a one-time thing. I get it often. That really upset me. I too grew up thinking healthcare is free in Europe, but that really isn’t true. It’s actually a lot more expensive than you think it is. And it’s definitely not free, at least not in the Netherlands, Belgium, Germany, and many other countries in Europe.

Where the Money Comes From?

Why do so many of us grow up thinking healthcare is free in Europe? A lack of education. First of all, even if it was free, it’s not actually free. Someone has to pay for it. You get what you pay for. Nothing in life is for free. Taxes in the Netherlands are astronomical. People pay anywhere from around 36% to 52% on income taxes yearly. As an American, I’m like holy guacamole, that is so much money that you’re making just to spend on taxes. Taxes a crazy high. I just bought a new laptop and the tax for that was 21%.

In the US, paying for healthcare out of pocket or through insurance is so expensive mainly because of two reasons. There aren’t a lot of laws to control the price, and people don’t pay enough in taxes for the government to subsidize healthcare.

But in the long run, it is worth it. Healthcare here is a lot less expensive here than in the US. If you get sick, you still have insurance. It is required by law to have health insurance. It is impossible to live here and not have health insurance. If you can’t afford the cost of insurance, the government will help you afford it. It is a human right to have access to healthcare if you need it.

There are so many other things that you get in return for paying high taxes. You get a normal pension. In the US, we are always worrying about how we are going to retire. People invest money in funds like a 401k or IRA to have money for retirement. I do this too. People don’t have that worry here. You get sick pay, even if you’re sick for a long time. You get normal unemployment payments that are actually livable. The list goes on and on. And here you get all of those things because you just pay for it by paying much higher taxes.

Do Not Delay

At the end of the day, you need to decide whether you want to live in the (for example) US, where your taxes are very low but you need to worry about how you’re going to pay for healthcare, etc. Or you can live in (for example) the Netherlands, where you pay high taxes but get all these things in return. You can’t just expect the government to give you all those things for free. Someone has to pay for it. Printing money is not the solution. That is how inflation happens.

I’ve heard so many stories of people in the US delaying going to the doctor because they can’t afford it. The thing is if you delay going to the doctor when you have something that can be managed, for example, by medication, it could turn into something much much worse. And I promise that will cost you way more money than if you initially went to the doctor and didn’t wait.

My Yearly Healthcare Costs

In the interest of transparency, this is what I paid for health insurance in 2020:

€126,50 ($150) monthly

€37,91 ($45) quarterly for birth control (my boyfriend pays half of this cost)

€385 ($457) for the yearly deductible

€5 to €80 ($6 to $95) a year for the dentist. I’m only covered for 80% up to €250 ($297) a year.

Certain medications and other things are not included in the cost of what I pay for above. For example, I paid about €220 ($261) for an insole for my shoe.

That means I paid already paid more than a whopping €2054.64 ($2,438.94) in 2020 just for recurring healthcare costs. That doesn’t include things that aren’t covered by my insurance like certain medications. According to Dutch standards that is pretty normal, but by American standards, it is super cheap.

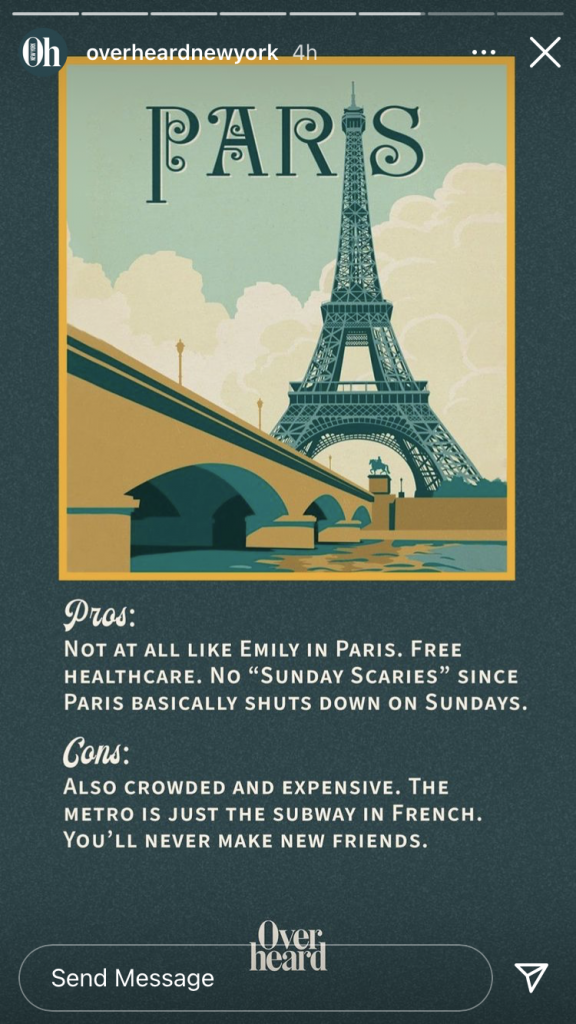

Media

So please, the next time you tell someone that healthcare is free in Europe, think again. And if you think, oh, that’s not true, people don’t say that healthcare is free in Europe, just look at this photo put on overheardnewyork’s Instagram story recently. They recently put out this photo saying that free healthcare in Paris was a pro to live there. That means, they told 1.4 million people a lie. Healthcare is far from free in France. People pay money out of pocket and through taxes to the healthcare system. It is not free. It is much cheaper out of pocket in Europe than in the US, but not free. Taxes just cover a lot of it.

People living in countries like the Netherlands pay a lot for healthcare. And it’s paid not only through the costs you see above, but also in taxes. If taxes weren’t that high, the upfront costs mentioned above would be much higher. Like most things in life, I’d say everything in life, healthcare costs a lot of money. It’s just a matter of where that money is coming from and how the government budgets that money. Some countries focus on, for example, having good schools, or good roads, others focus on healthcare.

Be sure to follow me on my Instagram and my Facebook where I post all about Dutch living and more.

What do you think of the cost of healthcare where you live?

Hi,

I appreciate that you are talking from your own experience but that isn’t representative of the entire United States. I live in NYC and just filed my taxes for the year so I have the number handy. I just paid 38% in income taxes for 2020. Sales taxes are also nearly 9% here.

I’m also interested if any of your prices of your healthcare costs are related to your not being a citizen.

No, healthcare cost the same here if you are or aren’t a citizen. NY I believe has the highest income tax in the nation. Most states pay much lower. I lived in NYC for a few years and paid those high taxes. They are higher here. 9% sales tax is really nothing. We pay at least double that here. Thank you so much for reading!

Nope. All that applies the same for Dutch citizens and foreigners.

Hi Soreh! Just to straighten out some facts in the US, one thing is federal tax and another is the state tax. The federal tax in the US is quite comparable to most western European countries. There are 7 different tax brackets one may fall into in the US depending on your income, the highest being 37% (Source: https://www.taxpolicycenter.org/briefing-book/how-do-federal-income-tax-rates-work). The US doesn’t have a centralized healthcare/universal healthcare system for many reasons, one of them being its capitalistic nature (other reasons why the US doesn’t have universal healthcare: https://theconversation.com/three-reasons-the-us-doesnt-have-universal-health-coverage-67292).

Having said that, thank you for pointing out that healthcare in Europe isn’t free, because it isn’t. Just like you said, we pay for it through our taxes. I can’t speak for the Netherlands, but I am a dual Italian citizen living in Spain, and I don’t pay a dime for primary healthcare and hospital/hospitalization-related expenses. Through my job I have an additional private healthcare insurance to have a more personalized healthcare provider as opposed to just dealing with a public healthcare doctor, which gets switched/rotated every so often (I’ve had 3 different doctors in the past 3 years through my public healthcare). I pay about $55/month. It was rather similar when I lived in Austria. I do know my American friends don’t have these same options unless they have permanent residents status in Spain.

Check your medical insurance you should be able to get those insole paid by the medical insurance. You pay upfront then declare it.

I use podozorg for my insoles & they are paid for by my medical insurance. I have AnderZorg.

Thank you! I appreciate the suggestion!

In other countries, you have to fight for both. Well excellent comparison done

Every country has got its good and bad things. Thank you for reading!

Yes, well sure, of course the money has to come from somewhere. I mean you can’t hang your coat on sky hooks, someone has to make those hooks to hang up on. But it is the ‘mass’ that makes it cheaper. If 17 million people have mandatory health insurance, divide the cost over 17 million premiums it becomes much cheaper. In the US, when I arrived in 1977 it had ‘only’ 220 million people versus now 330 million, more that 30 million have no insurance and almost 35 million live below the poverty line. In the USA 2 types of taxes, they will add up as wel, the federal and state tax and each state has their sales tax in different levels.

In Europe we know what the taxes we pay are for and a large chunk comes back in paying health cost, pension/SSN, education costs etc. In the USA you pay maybe lower taxes, but almost none if it comes back to the public in one way or another, it is gone…… in salaries for the many government workers, defense, and subsidizing the rich who pay much less taxes percentage wise that the common folks. Your taxes are more paid for the privilege’s of living in the US of A, but are not feeding you in times of need or retirement. (just a very small amount for SSN when you are 66 if you have held a job all those years.)

But you are making a few small calculation mistakes, you are adding up all the amounts you wrote down as yearly cost. The yearly basic cost are only the insurance premiums that are just about equal for everyone. If you can’t afford the premium, or your income is too low, you will get part of it back in a ‘toeslag’ (compensation) when you file your taxes(in the Netherlands), but you can get it ahead of time, you don’t have to wait until the year is over.

All you have to calculate are the monthly premiums €126,50 x 12=€1518. All the other amounts you wrote down are only for when you do get sick and you have to pay a small amount yourself like an own deductible etc. So that will be different for everyone.

2nd mistake is in the sentence : “…Taxes a crazy high. I just bought a new laptop and the tax for that was 21%.” if you check the total sales price(because in the US they are advertised not including sales tax) and the sales price in for instance the Netherlands inc. the sale tax, you will see that the total price do not differ much. So if the sale price is maybe 2 to 5% higher in the Netherlands for a laptop including the high sales tax of 21% and in the US with the lower sales tax(different per state most states 7,5 to 9,5%) and still the price of the laptop does not differ more than 5% between Europe and the US? Who is making the money?

The way taxes are paid and used back towards the community is much more transparent in the EU than it is in the USA.

Taxes here in the Netherlands are not more transparent than the USA. I highly beg to differ on that since I am a born dual US/Dutch national living in the Netherlands.

You’ve obviously never had a debt with the belastingdienst or better yet, you’ve never had someone die and leave you a house here, then you get to pay taxes on an inheritance that’s already been taxes times before. Call the belastingdienst to pay your debt, they’ll never disclose the full amount for you to pay, they want a hold on you forever so you must hire an attorney to close the deal.

I get your point but based on my own experience of living in the States (Boston) most of my early life and now in the Netherlands for half a decade, I can say you are pretty misinformed about some of the topics. You are definitely getting tax brackets wrong both in the US and in NL, you don’t mention the government subsidies that you can get in NL if you are unable to afford health insurance, and you don’t seem to take into account that healthcare costs beyond the basic insurance differ for everyone. Plus I notice that you are paying quite some money for your birth control. Almost 40 EUR every three months? I’m really curious as to what birth control you use haha.

Moreover, as someone else pointed out in the comments, I also believe you can get your insoles covered by your insurance. I think you are trying to make an interesting point but missing some nuances. As for the matter of free healthcare, you’re right, it’s not free. But in case of a serious illness, or even a mild one where you incur hospitalisation costs, etc., you will notice just how efficiently these costs are covered because of how your insurance policies are designed. So while not free (and honestly why should they be?), they are pretty damn good in case of an actual health-related emergency.

I appreciate you sharing all of that!

I don’t think she is misinformed. That’s a pretty bold statement to only live in a country for 5 years and to label another immigrant as misinformed.

Spreek jij Nederlands? Jij zou goed Nederlands moeten spreken als je in Nederland al vijf jaar woont. Wees voorzichtig met wat jij denkt dat jij weet, iedereen heeft zijn eigen ervaring.

That is language elitism and I won’t stand for it. I won’t even grace your comment about the language(s) I speak because frankly that is none of your business and not even remotely the point of discussion here. As for being a bold statement or not, why don’t you counter with actual facts instead of trying to insult me based on my immigrant status and my number of years here? Seriously, shame on you.

I also get the assumptions about “socialized medicine” all the time, and also that we have free education in NL; both untrue. We don’t have public health insurance; it’s all private. What you pay depends on your income level and which plans you choose and how high of a deductible you want to pay. If you are at the poverty line then the government does subsidize as they also do for students over the age of 18 (both of my daughters have health insurance which is covered by the government – they are 20 and 24 years old). They were also both either free or very low cost when they were under 18, so no child here goes without healthcare – ever!

Taxes are structured in tiers but not across the board: my husband pays around 40% on his income under 50,000 euros and 52% on everything above including his vacation and end of year bonuses. People who only make around 50,000 a year thus pay quite a lot less than those who make more. We have private insurance for the family but it’s only about 475 a month with a deductible for each of us quite high at 860 euros. I’m just back from the U.S. and most of the people I talked to said they say at least $500 a month for themselves in insurance, and some were much higher. A rather typical price for insurance for a family of 4 in the U.S. seems to run at a minimum of $2,000 a month! That’s insane.

One of the other reasons we pay less for healthcare is that medical expenses cost less here than in the U.S. where they are inflated by capitalism, and malpractice insurance rates. There is not a suing mentality here in NL and even if you did you will not find the million dollars of payouts like in the U.S. So they can keep some of their costs down that way and it gets passed on to us, the consumer. The basic package of healthcare is adequate, by the way, but not super duper. I end up paying a lot for catastrophic coverage because we almost never visit the doctor unless it needs more specialist care and that comes off of your deductible whereas doctor’s visits do not, but there are really limited things your doctor can do. I’d rather pay less and pay out of pocket for my normal medical visits and just pay a smaller amount for catastrophic coverage like accidents, long-term illness etc.

Another bonus is that all vaccines, health screenings like mammograms and colon cancer screening, etc. are FREE here, no matter what level of insurance you have. All children see health and development specialists every few months for the first few years of life and then at least once a year after that, for free. There is currently no deductible for children under 18 – all of their care up to the level of care their parents pay for are covered. Still not “free” because people who make more money pay higher taxes, but it’s still way better than the U.S. There *are* other countries that do a better job of providing (seemingly) free healthcare though. Spain was mentioned above and all the Scandinavian countries are much closer to socialized medicine than we are.

I’ve been wanting to write and correct the assumptions so many have that we have free education over here (including Bernie Sanders) – now that’s really a myth, at least in NL. So not free in any guise! (though again, much more affordable than the U.S.) The countries that do have free education (even for foreigners) like Norway, Iceland and Finland have exorbitant cost of living, so there’s that. It can almost wipe out the advantages of no tuition.

I’ve read several just right stuff here. Certainly price bookmarking for revisiting. I wonder how a lot effort you place to create this kind of great informative website.

Thank you for the amazing blog post!